Introduction

This report has been developed for two (separate) coffee and doughnut shops located in San Francisco who are seeking to maximize their trade areas without entering into direct competition with one another.Within their overall goal, the store owners have identified five questions they would like answered:

- What is the market like for both stores?

- Who are the store owners' core customers?

- Are they competing for the same customers?

- Is one store in a better position than the other?

- Where are their competitors located?

- current customer locations relative to both store locations

- competitor locations

- customer-derived trade areas

- demographic data on current customers based on customer-derived trade areas

- walk-time trade areas

Customer Locations

Customer addresses provided by each of the coffee and doughnut shops show the tight concentration of customers around each shop. This falls in line with the store owners' impression that a significant portion of their business comes from customers who walk.Store 1

Store 1, to the north (see Figure 1), shows the heaviest concentration in a 3 x 4 block (square) area surrounding the shop. There is small contingent of customers extending further east into and spread throughout Chinatown.Also, Geary Boulevard seems to pull customers from further west in the Richmond District and even down into the Sunset District.

Store 2

The heaviest concentration of customers for Store 2 are not encapsulated as the customers for Store 1, due in great part to the lack of a similar grid-like structure to surrounding streets (see Figure 1). The slightly more elongated pattern stretches tightly southwest into Bayshore while reaching out more broadly north into the Mission District and east into the west edge of Ingleside.In addition to the proximity patterns, the linkage between the Lames Lick Freeway and Highway 280 pulls some customers from the northeast and even the Bayview District. Similarly, the linkage between CA-1 and Highway 280 appears to pull some customers from throughout the Sunset District.

Figure 1: Coffee and Doughnut Shop Customer Locations for two stores in question in San Francisco

Competitor Locations

Clearly, San Francisco is not lacking for competition in the coffee and doughnut shop market. Coffee and doughnut shops can be found in various concentrations throughout the study area. This includes stores almost on top of the two store-owner locations.

The most heavy concentration centers in Chinatown directly east of Store 1. This concentration pattern spreads from Chinatown to the southwest into the Mission District ending, generally, north of Clipper Street with Store 2 further to the southeast.

Generally speaking, Store 1 (to the north) faces much heavier competition in the area directly around their location when compared to Store 2.

Figure 2: Coffee and Doughnut Shop Competitors throughout San Francisco

Customer-Derived Trade Areas

Business Analyst, a program developed by ESRI and implemented using ArcMap software allows for the creation of customer-derived trade areas. The rings produced using this method indicate the area containing 40%, 60% and 80% of a store's customers.

Using this method of analysis, Store 1 derives its customers at each percentage interval over a significantly smaller, more compact land area than does Store 2. Particular shapes for each ring appear to reflect the location of parks, major roads and other features.

Noticeably, the concentration of coffee and doughnut shops witnessed in Figure 2 appears to influence the 80% ring for both stores. This concentration likely detracts each store from pulling customers in larger percentages from the northeast Mission District and Chinatown.

Figure 3: Customer-derived trade areas for both coffee and donut shops under analysis

Demographic Data

Based on the customer-derived trade areas developed (see previous section), Business Analyst ESRI software produces a Community Profile report and a report entitled Retail Goods and Services Expenditures. These will be used to develop a picture of the clientele for each store.

In addition to more typical data about population such as population age, home ownership vs. renters, and purchasing habits, Business Analyst develops a picture of residents of a certain area by breaking them into tapestry segments intending to capture many features of the population into groups based on these features. These tapestry segments are provided for the three customer-derived trade area groupings for the areas where 40%, 60%, and 80% of a store's customers are located within. Information about spending patterns, median age, and median household income are provided within each segment description.

Store 1

The top tapestry segment for each customer-derived trade area for Store 1 is entitled 'Laptops and Lattes' (see Figure 4). While this segment represents a noticeably strong 32% of Store 1's customers in the area where 40 percent of it's customers reside, this percentage continue to strengthen (to above 40%) as you move into the 60 and 80 percent areas.

Figure 4: Laptops and Lattes tapestry segment

In addition to this predominant segmentation, two other segments follow in-step. The 'Trendsetters' segment (see Figure 2) represents between 20% - 25% of Store 1's customers in each customer derived trade area while 'Metro Renters' (see Figure 3) follows with between 15% - 20% of customers.

Figure 5: Metro Renters tapestry segment Figure 6: Trendsetters tapestry segment

Using data provided for each of these tapestry segments, approximately 80% of the people living in store 1's customer derived trade areas are between 30 and 40 years old. They also have a tendency to stay connected through social media sites and their cell phone and are prone to utilize public transportation, bike or walk.

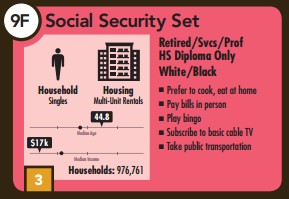

Two other segments appear most often in Store 1's tapestry segments and appear to diverge from the predominant theme developed thus far. Both the 'Social Security Set' (see Figure 7) and 'Retirement Communities' (see Figure 8) figure into their customer derived trade area with the former representing anywhere from 8 - 15% of the population throughout and the latter representing 7% - 14% of the population in the 40% and 60% customer derived trade areas.

Figure 7: Social Security Set tapestry segment Figure 8: Retirement Communities tapestry segment

These populations are older with median ages between approx. 45-50 years, considerably less income, and tend to cook at home more.

As a whole, each tapestry segment noted here is defined by singles living in multi-unit rentals as opposed to married couples living in single-family homes.

Looking at the Retail Goods and Services Report shows that residents in the customer-derived trade areas spend $4,000 - $5,000 on food outside of the home (see Figure 9).

Figure 9: Money Spent on Food Away from Home per year by Customer-Derived Trade Area

Taking a look at where the population is headed from 2010 to 2020, the Community Profile report projects steady numbers for all population categories between 15 and 64 years (in ten-year increments) other than a steadily decreasing 15-24 year-old population both by 2015 and again by 2020. The 25- 34 year-old population segment is noticeably the strongest representing approximately 25% of the population in each customer-derived trade area throughout the projection window. A drop-off in population into the mid-teen percentages occurs for the 35-44 and 45-54 year-old age cohorts. this is followed by another noticeable drop-off to around 10% for the 55-64 year-old cohort.However, these numbers are not declining throughout the decade; rather they hold steady in each age cohort.

Store 2

The tapestry segment that makes up the greatest percentage of the population for Store 2 is 'Urban Chic' (see Figure 10). It makes up the largest percentage of both the 40% and 60% customer-derived trade areas at just above 25% of the population and falls to third at just above 15% of the population in the 80% trade area.

The Pacific Heights tapestry segment (see Figure 11) runs a close second representing around 20 - 25% of the population in all three customer-derived trade areas

Figure 10: Urban Chic tapestry segment Figure 11: Pacific Heights tapestry segment

These two tapestry segments have a median age between 40 and 45 years old with a median income of $75,000 - $100,000. They appear to be more focused on automobile ownership, investments, and various forms of entertainment. There also is an indication they may prefer online shopping.

As you move further away from Store 2 (by trade area), the 'Laptop and Lattes' segment (see Figure 12) becomes more and more influential increasing from 11.5% to 21.5% and again to 25.10% in the 80% customer-derived trade area where it is the most prominent tapestry segment.

Figure 12: Laptop and Lattes tapestry segment

The third grouping of note within the tapestry segments belongs to both 'City Lights' (see Figure 13) and 'Downtown Melting Pot' (see Figure 14). These segments are typically between 35 and 40 years old with median income between $45,000 and $65,000. They appear to be noted for frugality and utilize the internet for banking and entertainment. Interestingly, they are both noted for various forms of involvement with the lottery.

Figure 13: City Lights tapestry segment Figure 14: Downtown Melting Pot tapestry segment

Overall, each tapestry segment noted for Store 2 is defined by married-couple households living in anything ranging from single-family homes (the most prominent) to multi-unit homes to high-density apartments.

The Retail Goods and Services report shows that residents living in the three customer-derived trade areas for Store 2 spend roughly between $5,000 and $5,500 on food away from home per year (see Figure 15).

Figure 15: Money Spent on Food Away from Home per year by Customer-Derived Trade Area

An overview of where the population is headed from 2010 to 2020 shows similar percentages holding steady in the mid-teens for each 10-year cohort from 25-64 years old. The 15-24 continues to hover around 10% of the population throughout the decade.

Walk-Time Trade Analysis

Walk-time trade analysis indicates the areas that are within . 5, 1 and 1.5 mile layers around each location. As a result, barring specific obstacles impeding walking, similar walk time areas should be produced for each store. While the exact shapes for each store are different, this is ultimately due to the shape of the streets surrounding. That being said, the overall area covered appears similar for each store.

Store 1

A very square shape develops around Store 1 with the longest reaches falling along the streets moving directly north, south, east, and west. This pattern fits with the more uniform grid pattern of streets surrounding the shop.

Store 2

The irregular street pattern around Store 2 leads to similarly irregular walk-time areas. The pattern is longer and thinner with a slight northeast to southwest tendency. The pattern is lengthened the most along main streets proceeding directly from the store in a similar fashion.

Figure 4: Walk-Time areas for both coffee and doughnut shops under analysis

Discussion

Store 1

Customer Location and Competition

Store 1 possesses a much more compact customer base for a couple of reasons. First, there is significantly more competition on the northeast of San Francisco. Second, the pattern of living is typically muti-unit to high-density apartments. this allows coffee shops to exist, potentially even on the same block while still wielding influence over an area with a high population.

As a result, the customer-derived trade areas for Store 1 tend to be similarly tight and compact around the store only beginning to differentiate in shape in the '80% of customers' trade area. Where it is able to branch out a little bit is in areas that move away from the higher concentration of coffee shops to the east and southeast.

Demographics

The customer base for Store 1 is heavily influenced by a 25-34 year-old population segment consisting mainly of single households as opposed to married couples. The strongest sub-set of this category possesses a median income of above $100,000 while the remaining segment has a median income of around $50,000.

Importantly, each of these segments appear inclined to utilize public transportation, walking and biking while also exhibiting a strong proclivity for connection by cell phone and through social media. As a result, they tend to fit the general personality of people thought to frequent coffee shops in a downtown setting.

While the remaining population segments tend to fall into older age-cohorts, they are, notably, still mainly single households. This segment of the population has increasingly been attracted to downtown living now that children have moved out of the house and there are less responsibilities. As such, this segment may further buoy rather than detract from the more dominant young, single population around them.

The Retail Goods and Services report indicating how much these populations spend outside of the home are somewhat inconclusive but also indicate that they spend less, on average, than do those living in the customer-derived trade areas around Store 2.

Looking toward the future, the makeup of the customer base for Store 1 appears to hold steady throughout the next decade. the only element of minor concern is a steadily decreasing population of 15-24 year-olds. Still, with strong numbers throughout the other most relevant cohorts, this should be the source of little worry.

Store 2

Customer Location and Competition

Store 2, on average pulls 40, 60 and 80% of its customers from a larger area than does Store 1. There are a couple of factors influencing the customer-derived trade areas in this way. The streets are not grid-like as seen for Store 1, meaning it is likely less easy to reach Store 2. In addition, Store 2 appears to be located in a less dense area. They are located in an area with far more single family dwellings and fewer multi-family and high-density apartments. Therefore, there are fewer customers available to them in a given area.

The pattern of larger customer-derived trade areas encompassing a given percentage of their customers also suggest their location may pull in more customers who drive compared to Store 1. This is reinforced by the tapestry segments for Store 2 that indicate their customer base utilizes public transportation, walking and biking less and invest more in vehicles.

There is considerably less direct competition in the area immediately surrounding Store 2 which might suggest they are in a more enviable position. However, this may simply be due to the fact that they are in a less-dense area where people tend to be slightly more car-centric.

Store 2's customer-derived trade area comes to an abrupt end when it reaches the area to the northeast of their location where coffee shops begin to be more concentrated whereas these trade areas continue on further in other directions where there isn't the same concentration of competition.

Demographics

Store 2 faces a customer base that is distinguished by married couples living in single-family homes. While the larger sub-segment of this group have median incomes from $85,000 - $10,000, approximately, they also see a relevant amount of married couples living in multi-family or high-density apartments while also having lower median incomes between $45,000 and $65,000.

Public transportation is not an important element for three out of the four tapestry segments composing the married couple element of Store 2's customer base, indicating vehicular transportation is in high use.

There is far less of an overall indication that the entertainment practices employed by all four of these tapestry segments are as conducive to a typical coffee shop crowd. They tend to employ different forms of entertainment out-of the-house while also focusing on online connections that tend to practiced more at home than in a coffee shop setting.

That being said, approximately 25% of Store 2's customer base consists of the highly desirable tapestry segment, 'Laptops and Lattes'. However, this segment of the population in their customer-derived trade area is more prominent in the outer rings. This suggests that Store 2 is located in a very family-oriented setting with many single households on the fringes of their trade area. This tapestry segment of the population likely helps Store 2 but is not strong enough to warrant more dense competition.

The Retail Goods and Services Report indicates that households tend to spend more on food outside of the home in Store 2's trade area than do households in Store 1's trade area. However, it could be argued this is due to the presence of more children for the 75% of the population that is married.

Conclusion

Market and Core Customers

Store 1 has a strong setting in a prominently single household area featuring high density living where people walk, bike, and take public transportation and utilize their phones and social media for communication.

Store 2 is located in a market defined by married family households with the largest segment consisting of single family households. Typical vehicle transportation tends to be employed in their trade area. Internet connection tend to be of the variety that takes place in the home.

Customer Competition

The two stores are, largely not in competition for the same customers outside of the ideal 'Laptop and Lattes' tapestry segment seen in both trade areas. However, Store 2's customer base is 75% married families - they are largely not in direct competition. In addition transportation employed by customers for each store further differentiates them.

Position

Based on the analysis, despite the fact that Store faces much stiffer competition. There trade area is strongly and ideally suited to attracting customers. The outlook for the future indicates they will continue to hold the advantage of an ideal customer base.

Store 2 is, by no means, in a bad location. However by indicating they appeal to traffic involving walking and biking, they may be out of position by being located in an area where there greatest appeal would be to those driving automobiles.

Competitors

Store 1 faces stiff competition typically to the east and southeast of their location while competition is less prominent in every other direction.

Store 2 faces competition of the much more sparse variety in keeping with their location in single-family households with higher density living on the fringes. Thus, there is probably less direct competition for the variety of customer they appeal to - the walk-in crowd.